Time to put this to rest...

-

@bellwells said:

I sure wouldn't be too happy about getting support from this guy.

http://www.youtube.com/watch?v=OowxMcVTjTELooks like you've got something in common with Barack Obama then. He's not happy with it either.

-

@bellwells said:

@schreiberbike said:

As opposed to limited contact with a University professor who did some dumb thingsthirty years ago.

Bombing is a dumb thing...hmmm. I probably wouldn't use that adjective. Wow, it boggles the mind how Obama supporters are so damn eager to overlook this stuff. I guarantee that if McCain had any similar associations, all hell would break loose. Hypocrites all.

It seems to me that partisanship is stronger now than at any other time I have been aware of. It's hard for anyone to look objectively at anything which could be called facts. I'm not impartial, but I see people on both sides being ridiculous in how they see the facts. Both the Obama supporters and the McCain supporters have at various times felt like the media was against them. Both have used lines like yours above. Our victim culture is so strong that even when you are running for President, and close to half of the country supports you, it's still someone else's fault when things don't go your way.

If we can't learn to see things from outside of our narrow point of view, this country will go to hell regardless of who is President.

Now, because I'm partisan, I'll respond about Bill Ayers. See if it makes any sense to you.

They were both highly educated, they were both involved in community issues at leadership levels, they were both liberals, they were both college professors, and they lived near each other.

They were either friends or acquaintances for a while.

Obama has played down any relationship while others have played it up.

Bill Ayers did some dumb things in the past. Dumb is closer than terroristic. Read about what he did - if that's your standard for a terrorist, it's not mine. Dumb is also appropriate in comparison with where he is now. He was Chicago’s Citizen of the Year in 1997 and truly is a valuable member of that community.

Regardless, does this have anything to do with who should be President?

Now, you say that if McCain did anything like this, "all hell would break loose." Let's make a list of candidates who have done any bombing. Well, Mr. McCain did more than a bit of that back in Vietnam. There is no question that innocent people were killed in those bombing raids. If he didn't kill innocents, he certainly associated with people who did. I don't hold that against him though. He was in the military. He did it under orders. He did it from thousands of feet from his victims. I haven't heard of anyone who has held this against him.

And, generally over the years, he has been a class act of a guy who believed in honor and dignity. I suspect that coming down to this level has been harder on him than it has on anyone else.

-

If you're looking at peoples associations, what about McCains association with Bush who is the biggest bomber of recent times and has not only brought this country to its knees but has wrecked havoc all around the world?

Mike

-

All people are associated, at least at the "has shaken hands with"-level. I just started counting. There are 3 people between me and Josef Stalin, and similarly 3 between me and Adolf Hitler. Maybe 2 between me and George W. Bush. I read somewhere that with 5 connections you should be able to reach almost everyone in the world.

Regarding Ms. Palin's report card - In our parts it would be illegal to put the colour of her skin on it.

Anssi

-

I appreciate your comments, John. Partisanship does seem to be at an all time high. It is certainly divisive, but it can be destructive as well; hampering quality conversation and debate.

My problem this year is that I have no respect for either candidate (obviously lesser so for Obama). This pisses me off. Even though I voted for Bush in 2004, I held my nose. I'm not doing that ever again. I will only vote for the person I like, no more straight ticket voting. There is a certain freedom that accrues with this attitude.

The liberals can have all the fun they want in bashing Sarah Palin. They should be talking about McCain instead. If Palin's job is to run defense for McCain and deflect attention, it's working, isn't it?

-

@solo said:

This is Palin's report card, see SAT's, now c'mon folks is this the idiot you want in Whitehouse?

Do you really believe this is true, Pete? Where did you get this crap? I really detest this kind of shit.

http://www.dailykos.com/story/2008/10/11/71941/717 -

Ron

Great find, I am sure you hunted high and low for that, is that real? There certainly are a lot of sites out there calling it legit, and only one (your post) saying otherwise. Who knows, maybe it is a little inflated for her.

@unknownuser said:

really detest this kind of shit.

like you posting Obama shining Palin's shoes is not a racist crappy posting huh?

-

Big difference between my Obama/Palin image and yours. You put your out there as true. My Lord, the DailyKos is one of the most liberal web sites on the planet. If they say it's not true, I would believe them.

It wasn't very hard to find this...just google "palin report card" and you'll see lots of sites. I chose this one because of the reasons above.

-

@unknownuser said:

the DailyKos is one of the most liberal web sites on the planet. If they say it's not true, I would believe them.

LOL now you believe the liberal media

You are a moving target.

@unknownuser said:

Big difference between my Obama/Palin image and yours. You put your out there as true

And let me guess, you put yours up because you are racist?

-

Pete, posting a link to a liberal web site debunking this report card was a way to convince you, get it?

Oh, there's that meaningless word again...racist. Is this supposed to bring the conversation to an end? A show stopper. This term only works on guilty white liberals. Hell, even Tom chuckled at the image. I'm sure you wouldn't DREAM of calling him a racist.

-

The left defines its own "truth", independent of the actual facts.. e.g., Clinton's "depends on what the meaning of 'is' is". That is the way of the leftist.

The Ayers quote is "I don't regret setting bombs...I feel we didn't do enough."

Assume Timothy McVeigh had been acquitted because of an error on the part of law enforcement (rather than being convicted and executed). If McCain had his political career opening at the home of McVeigh, the left would be absolutely hysterical. If McCain had only attended some board meetings with McVeigh, the left would be absolutely hysterical. But, the facts don't matter to the leftists. Ayers was acquitted due to technicality. Obama now says William Ayers was rehabilitated. Weeks ago, they just lived in the same neighborhood; their children went to school together; and, Obama was only 8 when Ayers was an active terrorist. How old was Obama when they were meeting together? In his 30's and 40'. The question is, what's the difference between the terrorist Ayers and the terrorist McVeigh? Answer: Justice.

Then, there's J. Wright. It doesn't take much research to know the depth of that 20 year relationship. How could anyone not believe Wright is a racist and a race baiter? Obama never knew.. oh, that's it, Obama never knew. If that's not good enough, read some excerpts from Obama's "Dreams from My Father". Anyone that's has a shred of intellectual honesty can't ignore the racial animosity expressed by Obama.

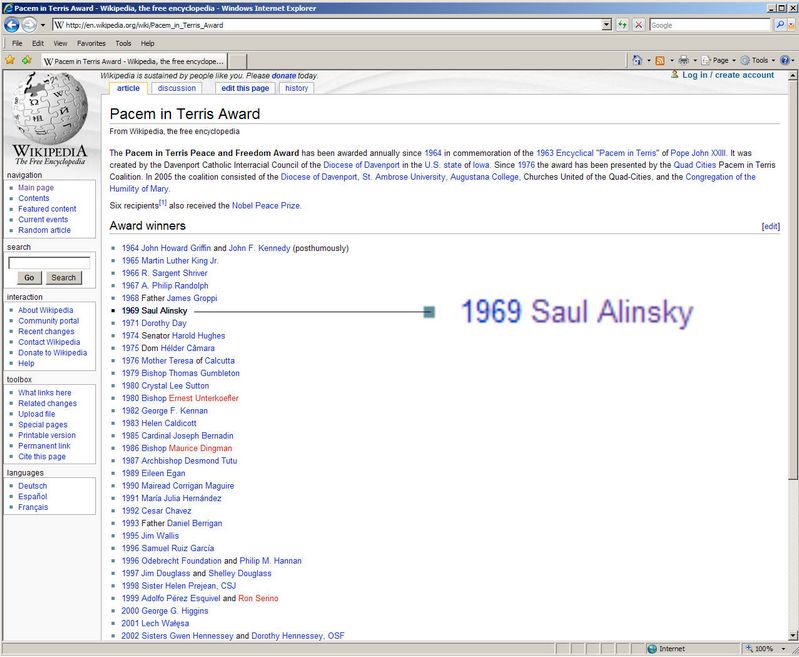

Obama studied from the original community organizer, Saul Alinsky, author of "Rules for Radicals". Alinsky outlines the basis for Obama's underlying leftist/Marxist political philosophy and the methods for implementing that philosophy. This is the most disturbing connection, because it explains how Obama has been able to convince the intellectually lazy to follow along.

Then, there's T. Rezko,.. then, there's ACORN,.. then, there's the Chicago political machine,... All these are shining examples of political corruption.

These relationships seem to go on and on.

Only the most naive and the most sympathetic to the radical left could ignore Obama's connections. The suggestion that McCain's military service has any equivalency to Ayers is just too lame to elicit a response. McCain isn't perfect, but he's infinitely more desirable than Obama.

It is incomprehensible to me that any US citizen would like to see the US turn into a leftist-socialist-marxist country. And, to all those in other countries around the world, you should be very afraid if the US does turn. I guarantee that you would be in the cross-hairs of such a powerful state. Better be careful what you wish for...

-

Oh boy! not another one.

They call it the 'Halloween vote', scare the masses into voting your way, the conservatives have been doing that for ages and it worked twice with Bush, America is tired of these tactics, and the polls are reflecting that.

WTF is up with all this marxist, communist, socialist talk, missing the cold war? need another McCarthy era?

-

@bellwells said:

...Hell, even Tom chuckled at the image...

Ron, I also expressed my regret for not noticing the glaring racial overtones of the image.

-

@tomsdesk said:

@bellwells said:

...Hell, even Tom chuckled at the image...

Ron, I also expressed my regret for not noticing the glaring racial overtones of the image.

I don't remember that, but I do remember something about you being pissed at yourself that you chuckled.

Pete, we've gone off track about the fraud of Palin's report card. If, in a few seconds, I could find the DailyKos link debunking this, then you must have seen it and the many others that I came across. Apparently, you chose to overlook these dissenting opinions and go right for the Dan Rather solution. I'm disappointed.

-

@david. said:

...intellectually lazy...

It only took my visiting one site to debunk your claims the associations you mentioned indicate "political corruption"...hummmmmmmmm.

http://en.wikipedia.org/wiki/Association_of_Community_Organizations_for_Reform_Now

http://en.wikipedia.org/wiki/Tony_Rezko

http://en.wikipedia.org/wiki/Saul_AlinskyAlinsky: thank for the heads-up, sounds like someone interesting to read...and kuddos to Obama for studying him!

And finally I gotta say: Your ludicrous comparison of Ayers, who claims to have been involved with three bombings with NO casualties...as intended (no I don't condone, at all!...but did smile at reading they managed to stop the bombing in Vietnam for several days :`), to that heinous murderer McVeigh is unconscionable. You should be ashamed of yourself! -

Thanks Ron...sounds a lot different that way than the first time you mentioned it, huh?!?

-

"Time to put this to rest" is on it's third page. Apparently not time yet.

Hope we don't lose any friends here.

-

Tom, ACORN has admitted fraud in voter sign up. This group should be outlawed and the organizers horse whipped.

-

First, I sometimes disagree strongly with other people. But I have found that if I converse respectfully and try to understand the other person's point of view, I often learn that I have quite a bit in common with the person. I hope that can happen to all of us here.

Second, piling on additional arguments, in this case, other things to be perceived to be bad about Obama, has nothing to do with the original point. Adding additional arguments is typically a distraction used when the first argument has been lost. I won't respond to those.

@david. said:

The left defines its own "truth", independent of the actual facts.. e.g., Clinton's "depends on what the meaning of 'is' is". That is the way of the leftist.

There are immoral politicians on the left and the right. Here Clinton took advantage of a legalism to technically tell the truth while he deceived the grand jury. That made Bill Clinton look bad. I certainly prefer that to "We don't torture." Which is true only if you change the meaning of torture from what it has always been. That made the United States look bad and it made you and me part of an immoral system that tortures people to find out if they are guilty or innocent.

@david. said:

The Ayers quote is "I don't regret setting bombs...I feel we didn't do enough."

First, note the three little dots. That's where the reporter took out some other words. It could be that those words did not change the implication and Bill Ayers wishes he had set more bombs and that he wishes he could have caused death and injury. It also could be that the two sentences were not related and that they were put together to deceive. All of us know that the press sometimes deceives. To find out what his meaning was, the best we can do is read other things he has said and written. NONE of that indicates what is implied.

@david. said:

Assume Timothy McVeigh had been acquitted because of an error on the part of law enforcement (rather than being convicted and executed). If McCain had his political career opening at the home of McVeigh,

If in your example, 1) McVeigh had caused damage to property in an attempt to stop an immoral war instead of killing 168 and injuring 450 of which 19 were children in a day care, as part of his white supremacist beliefs in order to get revenge for "what the U.S. government did at Waco and Ruby Ridge", AND 2) McVeigh had since become a professor of education at a top university, AND 3) McVeigh had become a widely respected leader involved in making his community better, AND 4) McVeigh had committed those crimes almost 40 years ago, AND 5) McVeigh had hosted one of many fund raising meetings for John McCain who was not a close friend, perhaps then some on

@david. said:

the left would be absolutely hysterical.

But I don't think many would, and I wouldn't.

@david. said:

The question is, what's the difference between the terrorist Ayers and the terrorist McVeigh? Answer: Justice.

Do you really believe that, or is this just partisan rhetoric which distracts us from the real issues?

If you think Obama is the wrong choice for President, is this why, or can you tell us your real reasons?

-

Ron: read the article, (I even posted the link for you :`) You'll find only employees, I would guess temps hired short time, were charged in a few cases. I do think they are past overdue changing their way of reimbursing said employees: paying by the signature surely facilitates fraud.

Advertisement