Has anyone noticed the progression to a 'cashless' economy?

-

Taken as abstract 'tokens' representing 'value', I'm not sure that the form makes a huge amount of difference per se. Whatever form it takes, there will be (as always), a self-selecting few who will influence that value much more than the rest of us.

However, looking around me, I do wonder that the more we make money "abstract", the easier it is for us to spend money we don't have. I just think that maybe our brains aren't quite wired to truly make the connection between pure numbers and "value" - "how many bits and bytes are worth a loaf of bread?".And I really feel for those people who for whatever reason, are excluded from participating. For example, a friend of mine had a stroke a couple of years ago. His recovery has been made that much more difficult because he lost his memory of every single PIN number, can't write his own signature, and for a long time was unable to make himself understood over the telephone. The more we push financial services towards password protected computer systems and remote access, the more people there are going to be who find accessing their cash very difficult if they have a disability that makes the "user interface" impossible for them to negociate.

Something that's rarely spoken of is that huge amounts of financial services are run on computer systems running some form of COBOL code. If you never heard of COBOL, that's not suprising - it's a computer language from decades past that virtually no-one is taught any more, isn't at all cool and trendy, and is god-awful to write. The number of COBOL programmers needed to maintain things properly is dwindling, and no-one wants to wholesale move to another platform because of the consequences if that were to go wrong.

IMHO, sooner or later, this utter reliance on software that is too complex to ever be 100% bug-free, written before the maintenance guy was even born, is going to have some big consequences for the world economy! -

I hate PayPal because if you provide someone with a service, you finish that service, they can chargeback the money on their credit card with little to no explanation on their part, even if you win the dispute with the client, the credit card company will still take their money back and PayPal will then deduct that amount from your account. With no effort or concern for you, their client... Not such a big deal when it's $10-$50.00 but when it's $2000 and you spent weeks or months on a project only to have them get the service and their money back? Dispute resolution with PayPal is a joke. Whatsmore I have little recourse and no real competition for them since Google Checkout closed.

-

Excellent points Trog and I had never even considered that kind of issue with banking and payments. Here in the US we have this new system called Paywave?? And you don't need a pin or to slide any cards. just get near the box and the sale goes through.

-

@krisidious said:

I hate PayPal because if you provide someone with a service, you finish that service, they can chargeback the money on their credit card with little to no explanation on their part, even if you win the dispute with the client, the credit card company will still take their money back and PayPal will then deduct that amount from your account. With no effort or concern for you, their client... Not such a big deal when it's $10-$50.00 but when it's $2000 and you spent weeks or months on a project only to have them get the service and their money back? Dispute resolution with PayPal is a joke. Whatsmore I have little recourse and no real competition for them since Google Checkout closed.

ouch! doesn't sound like a repeat client

Yeah, I've read a bit about how small merchants can get really screwed accepting paypal. Any electronic pay service I've looked into thus far has too many fees and conditions that I didn't like. I'm still only taking checks.

-

-

-

I don't mind having authority over my accounting and customer service... But as most of us know, architecture clients are almost always in the wrong. We do tons of extra work and they can barely bring themselves to pay and then think they own the work. I just want a fair shake in the process and not just oh since the credit card company is going to protect their user, we're going to just allow them to steal thousands of dollars from you. With a digital product it makes it quite painful. My only recourse is to wait for them to build, hope I have their location correct and then try to put a mechanic's lien on the property and hope they sell one day... Before I die.

Anytime I can, I direct my clients to make hand deposits at my bank or to do direct wire transfers of funds. Then there is no bouncing check, no waiting for the postman, no canceled check, no paypal transaction fees, no chargebacks, no dispute resolution except what I am willing to concede to. I begrudgingly use paypal because I have to in order to sell plans on my website. Thankfully most people want it custom.

I've also noticed that people needing architecture work often don't have the free capital to spend on planning. they seem broke. They want systems like Paypal so they can put planning on their credit card and finance it. Wells Fargo at one time had a deal where they rolled planning costs into the construction loan and paid the architect or designer up front. That system is long dead though.

-

After many years of monopoly $$$$$$ printing machines are out of business. The end of $$$$. Euro-Asia central bank is taking control with its own currencies. So, let's make even more convenient system, where besides it has no real value, we do not have to print money at all. Just type it in the system. Who will have the control?

-

This will only be of interest to non US citizens currently.

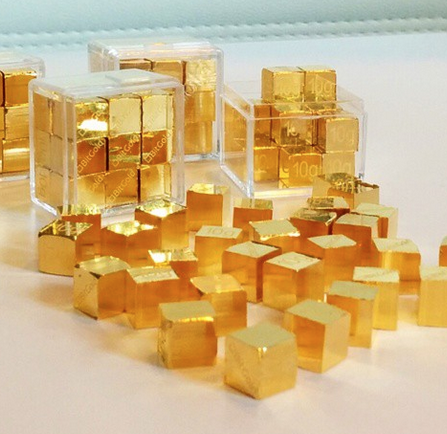

I came across BitGold today and am intrigued with what I see so far. In essence its a way to buy gold for a 1% levy, have it stored / insured for free, fully own it at all times, send and receive gold value payments and even have solid gold (10g Cubes or 1Kg bars) delivered to your door for a small cost. BitGold advise they they are launching a BitGold debit card (MasterCard) that will facilitate ATM cash withdrawals and other card payments.Here is a link, https://bitgold.com/r/mWPVjY to get some free gold, 0.25g worth €8.61 currently ....... next year it could be worth a lot more if the financial system goes belly up

Mike

-

Why only Non-Us? Fox watchers love gold... they're always talking about the system going down and gold being it.

-

Gold wont give you peace of mind, read: http://nok-ind.tumblr.com/post/2100405115/mansa-musa-one-of-the-richest-men-who-ever-lived

You can not own, nor put in a bank or safe, the most valuable things in life. -

@unknownuser said:

a self-selecting few who will influence that value much more than the rest of us.

Some of us simple folk have just departed into the forest to avoid banks. The picture is of my wood silo. I have two that hold approx. 8 bush cords each, that's about 7000$. I keep them full.

The silo is my pay pal when it comes to purchasing many things from the community. Eggs, milk, bread/wheat, maple syrup, feed for animals, crafts, furniture, tractors...

If you are looking for freedom then this is its real currency. I have watched free-enterprise kill democracy and freedom in the last 50 years. It is surprising how many others have just moved away from it as well. I recommend it to everyone. Once you get a taste of freedom again (very few in the free world have it any more) You will never look back.

PayPal is the antithesis of the freedom and privacy I enjoy.

-

Mike, the move to a more digital currency (which started decades ago in the US with the advent of debit cards) will not eliminate crime, only transform it. As evidenced by the rise in cyber crimes, such as identity theft. Nowadays, a thief no longer has to have physical access to your money to rob you blind.

Back in '89 I worked briefly in a bank as a coin wrapper, housed in the bank's vault. Even back then there was surprisingly little money in the vault, since most transactions by then were done electronically. That is why the U.S. Treasury stopped printing large denominations.

-

Look in the headlines. These too big to fail banks have finally been given criminal convictions but will continue to prey on people, just cuz. Paypal has been found guilty of signing people into a credit scheme without their knowledge. I'm currently trying to get some relatively small fees back from a "no fee" credit card (never used) (from my local banker) that, surprise, charges $50 a year for "rewards program" I never knew about.

Anyway. No, I have not noticed a change to cashless for many years in my daily life. Just more predatory banks. I use debit cards just about the same I did years ago.

-

@krisidious said:

Why only Non-Us? Fox watchers love gold... they're always talking about the system going down and gold being it.

Kris, It must be bloody annoying when you come up against this kind of thing particularly when in Canadian company of what appears to be good and solid standing.

I don't know why the US is excluded, probably because of some financial restrictions when it comes to purchase of gold or trading in a gold account. Could it date back to the Nixon days? I'll see if I can find out more.

-

Thanks Mike... That's Awesome Roland...

-

While I'm at it, here is another currency found in the bush. You might be able to guess. Quite an elaborate piece of architecture. Model that one for me.

-

Some things cannot be drawn, they must be made, for if you draw them first something is lost... This is one of those things. It's gorgeous.

-

@unknownuser said:

It's gorgeous.

Can you quess? -

@roland joseph said:

Can you quess?

Are you talking about a sugar bush?

Advertisement