Time to put this to rest...

-

John, we get Parade as well and I saw this graph. What this graph does not show is Obama intends to raise the capital gains rate from 15% to "as much as" 28%. He said this in one of the debates. What the hell does "as much as" mean? I say it means exactly 28%. You talk about having a chilling effect on investments and growth.

-

i know i am a newbie here, but under Obama's plan, why is my family being penalized for making more money?

FYI - my wife is the one who's job pushes us into the higher tax bracket.

-

@dcke88 said:

i know i am a newbie here, but under Obama's plan, why is my family being penalized for making more money?

Because you can afford to give more.

-

-

@dcke88 said:

that is alright. we are used to picking up the slack for those who can't do it themselves

because they have not had any chance to do it

could be ?

-

@unknownuser said:

that is alright. we are used to picking up the slack for those who can't do it themselves.

um... If indeed Obama does win it will be the first time you 'pick up some slack' as currently you pay proportionately less taxes and the poor and middle class carry you thanks to Bush's tax cut for the rich.

-

@solo said:

@unknownuser said:

that is alright. we are used to picking up the slack for those who can't do it themselves.

um... If indeed Obama does win it will be the first time you 'pick up some slack' as currently you pay proportionately less taxes and the poor and middle class carry you thanks to Bush's tax cut for the rich.

Whoa, this is flat out wrong! You'd better do some research on this Pete, because the facts are PRECISELY the opposite. The "rich" pay a disproportionate share of the taxes.

-

From the mouth of NOW America's richest man.

[flash=425,355:3tnzfdm6]http://www.youtube.com/v/Cu5B-2LoC4s[/flash:3tnzfdm6]

-

@bellwells said:

John, we get Parade as well and I saw this graph. What this graph does not show is Obama intends to raise the capital gains rate from 15% to "as much as" 28%. He said this in one of the debates. What the hell does "as much as" mean? I say it means exactly 28%. You talk about having a chilling effect on investments and growth.

Sounds like a good point, he said exactly that back in March.

I researched it. Here's the formal plan that Obama's campaign put out in August. That still seems to be his plan, but he has said that in light of the current financial mess, his plan may change to make recovery as easy as possible.

@unknownuser said:

- The top capital-gains rate for families making more than $250,000 would return to 20% -- the lowest rate that existed in the 1990s and the rate President Bush proposed in his 2001 tax cut. A 20% rate is almost a third lower than the rate President Reagan set in 1986.

- The tax rate on dividends would also be 20% for families making more than $250,000, rather than returning to the ordinary income rate. This rate would be 39% lower than the rate President Bush proposed in his 2001 tax cut and would be lower than all but five of the last 92 years we have been taxing dividends.

So for families making over $250K, yes capital-gains taxes will go up. Will that have a negative impact on growth? Perhaps a little, but it is still a lower tax rate than any time in the last century except for the last five years.

Personally, I've never understand the reason why capital-gains income should be taxed at a lower rate than earned income. It mostly seems to me to be a dodge so that the people with lots of capital gains (the rich) could pay less taxes.

The middle class has very little capital gains. They have little of the country's wealth in the first place and most of what they do have is in IRAs and 401(K)s and their homes which are tax sheltered anyway.

-

@bellwells said:

The "rich" pay a disproportionate share of the taxes.

Absolutely true.

But, the rich have a disproportionate share of the income and the wealth. That is part of capitalism, but right now the disproportion is extreme and I think dangerous.

Would you believe that the 400 richest American families have more wealth than the the bottom half of American families put together. Is this healthy? Inequality has never been this high before. The last time it was close was the year before the great depression. Could there be a connection?

Full image here: http://www.thenation.com/special/images/extreme_inequalitychart.jpg

-

@solo said:

From the mouth of NOW America's richest man.

[flash=425,355:3twkb4bn]http://www.youtube.com/v/Cu5B-2LoC4s[/flash:3twkb4bn]

Pete, I don't even need to watch the video to know what Buffet's opinion is. I already know. The fact remains that the top 5% (+/-) of earners pay something like 90%, or more, of all taxes.

-

"Would you believe that the 400 richest American families have more wealth than the the bottom half of American families put together. Is this healthy? Inequality has never been this high before. The last time it was close was the year before the great depression. Could there be a connection?"

DING>>>DING>>>>DING give that man a prize. This is precisely the problem. The culture of greed has been allowed to progress to the point that the wealthy literally have more money than they know what to do with. They certainly are not trickling it down. And if the tax laws allow them to keep more of it than they are not pulling their proportionate share of the cart.

How to reward people for attaining wealth appropriately is at question but a reward that is to the detriment of the masses seems inappropriate.

-

@tomsdesk said:

Alinsky: thank for the heads-up, sounds like someone interesting to read...and kuddos to Obama for studying him!

Kudos for studying a Machiavellian? Horse puckey (to quote you). If you really think that the ends justify the means, then you have absolutely no business complaining about anything you've complained about or mentioned so far, and you have no business saying anything else about the campaign, period. In fact, if you really believe that, you should applaud any smear tactic against Obama OR McCain as an embodiment of that philosophy.

That is, unless you intend to claim hypocrisy...

@schreiberbike said:

Would you believe that the 400 richest American families have more wealth than the the bottom half of American families put together. Is this healthy? Inequality has never been this high before. The last time it was close was the year before the great depression. Could there be a connection?

Full image here: http://www.thenation.com/special/images/extreme_inequalitychart.jpgThere's no connection, and it's irresponsible (though not unexpected) for The Nation to claim one. Charts like that are only good for class warfare hysteria to support socialist ideologies of income redistribution. To analyze the graph, note how much the ratio dropped after the 1929 crash, despite an unchanged tax rate combined with 25% unemployment. As unemployment exploded, the ratio should have climbed - unless the super-rich were losing disproportionately more income than the poor were, and with the losses went the means for providing jobs. If the claim were accurate, then the Depression should have ended around 1932, once the ratio got back to "normal".

No, the only connection between then and now is that average people (not the super-rich) were overextended on debt-to-income. The question is how they got overextended. The [url=http://www.lewrockwell.com/suprynowicz/suprynowicz95.html:212zuz9f]current answer[/url:212zuz9f] is liberal social policy, specifically the Community Reinvestment Act of 1977, pushed by a Democrat-controlled Congress and signed by a Democrat President, then broadly expanded by another Democrat President in 1995 - forcing lenders to approve large numbers of subprime loans (loans to people without the demonstrable means of paying back). This was exacerbated by Democrats stonewalling regulatory efforts throughout the first half of this decade that might have lessened the impact we are seeing now.

The problem is (generally) left-leaning politicians who think "economic growth" is higher taxes and massive government spending. It makes little sense for the fed to take money, filter it through a fed bureaucracy that doles it back out to state bureaucracies who then put it to work back where it came from, resulting in only a fraction of each dollar actually doing anything where that dollar originated. We as a society have become so entitlement-minded, thinking the government owes us handouts, that we forget it was the money we earned in the first place that is getting filtered back to us at a loss. I'm not giving a pass to Republicans, either, some of whom (especially G W Bush) have adopted the same "money is the answer" mentality.

@solo said:

um... If indeed Obama does win it will be the first time you 'pick up some slack' as currently you pay proportionately less taxes and the poor and middle class carry you thanks to Bush's tax cut for the rich.

That was a thoroughly uninformed statement. See [url=http://www.irs.gov/pub/irs-soi/05in05tr.xls:212zuz9f]the IRS data[/url:212zuz9f] on who is paying how much of the taxes, from 1986 to present, then get back with us on who's carrying whom.

@dcke88 said:

i know i am a newbie here, but under Obama's plan, why is my family being penalized for making more money?

FYI - my wife is the one who's job pushes us into the higher tax bracket.

It's not a penalty, it's an involuntary opportunity for you to be more patriotic. At least, that's the word according to Joe Biden.

@solo said:

WTF is up with all this marxist, communist, socialist talk, missing the cold war? need another McCarthy era?

We all remember (and are taught) the evils of the fascist Nazi Party in Germany during the 1930s-40s, but we seem to gloss over (or forget, or be ignorant of) the evils of communism/socialism. The fascists killed about 10 million in the 20th century - the communists killed about 100 million. Just for that reason alone, we should be much more seriously concerned about communism than we are. Paul Kengor had [url=http://www.americanthinker.com/2008/10/why_obamas_communist_connectio.html:212zuz9f]this to say[/url:212zuz9f] about it.

@unknownuser said:

The culture of greed has been allowed to progress to the point that the wealthy literally have more money than they know what to do with. They certainly are not trickling it down. And if the tax laws allow them to keep more of it than they are not pulling their proportionate share of the cart.

With all due respect: First, please check the IRS data for who is paying the bulk of the income taxes. Second, I'll agree that some of them probably have more money than they know what to do with (Paris Hilton comes to mind, who clearly has more dollars than sense), but many of them give away a considerable amount of money through foundations and charities, invest in enterprises that create jobs, and buy stuff (tons of stuff!), thus sending the money back into the economy. Trickling? Probably not. More like "pouring". And more and more families are getting "rich" (breaking the $250,000 bracket), too - through hard work, perseverance, and an entrepreneurial spirit, more are in the top tax bracket than 20 years ago, pouring more money into taxes. Yes, the rich are getting richer, but at the same time, more people are getting "rich" - and not by inheriting it.

Also, the "culture of greed" doesn't apply only to the rich - if it weren't for greed and envy, there would be no discussion of income redistribution.

-

@rickw said:

@tomsdesk said:

Alinsky: thank for the heads-up, sounds like someone interesting to read...and kudos to Obama for studying him!

Kudos for studying a Machiavellian? Horse puckey...

Machiavellian...”Suggesting the principles of conduct laid down by Machiavelli; specifically marked by cunning, duplicity, or bad faith.”

How else is one to fight the right-wing establishment except by use of their own tactics?

8~0

:`)Seriously, this sounded interesting to me:

"In the first chapter, opening paragraph of the book Alinsky writes, "What follows is for those who want to change the world from what it is to what they believe it should be. The Prince was written by Machiavelli for the Haves on how to hold power. Rules for Radicals is written for the Have-Nots on how to take it away."And this provoked my kudos to Obama:

“The documentary, "The Democratic Promise: Saul Alinsky and His Legacy," claims that "Alinsky championed new ways to organize the poor and powerless that created a backyard revolution in cities across America."And this has nothing to do with what I said about Alinsky:

@rickw said:

...If you really think that the ends justify the means...

Boy you guys have gotten angry since the latest polls hit the streets...huh?

-

Well said Rick. Paul Kengor's article is completely on target. It's unfortunate that some just don't get it. And, it's sad that some don't want to get it. For later, their motives are questionable, to put it mildly.

-

Alinsky absolutely believes the ends justifies the means. His looney leftist crap is based on it. He's a Marxist, a commie, a goofy nitwit like you-know-who. The left doesn't seem to care that names like his and Ayers and Wright and ACORN are in ANY way associated with Obama. You don't see these types of characters associated with McCain or Bob Barr or Nader or anyone else.

Sure...even though I'm a third party voter, I'm disappointed in the current polls. The last guy I want in the White House is a liberal socialist. But we've got some time left. The pollsters were wrong this time of year for the last 2 elections (or one of the last 2 anyway, I can't remember).

-

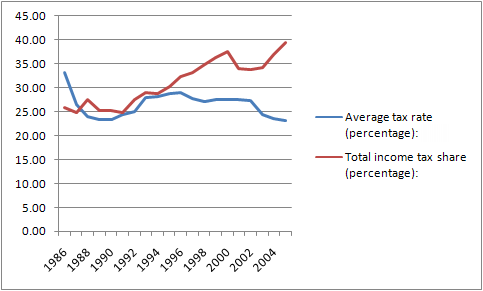

Using the data from the IRS, note that as the tax rate for the top 1% of earners dropped, their share of total income taxes increased. That's right - they paid a greater part of the tax burden when their average tax rate was lower (in particular, lower than 30%).

So, does that make any sense? Of course it does. dcke88 asked why his family should be penalized for earning more. And that's the question anyone in a higher bracket will ask. When the rich are demanded to "pay their fair share" (which they already do), two things happen:

First, there is less incentive to cross a threshold when the tax burden is greater, which could wipe out any gains in increased income (depending on the amount above the threshold).

Second, the top earners will do more to shield their income from predatory taxes (above 30% average rate), resulting in paying a smaller proportion of the total tax bill. This would be more evident if the data covered more than 20 years.A similar phenomenon happens with capital gains taxes - the lower the rate, the higher the tax income.

If everyone paid a flat 10% tax, that would be equitable, would it not? Each person would pay the same proportion of their income - their "fair share" - right? So how is it that the graduated brackets we have now leave some with the impression that the rich aren't paying their "fair share"?

Answer: class-envy rhetoric from leftist politicians incites people to:

- believe the lies that the rich are being carried by the poor and the middle class.

- think that making the rich "pay their fair share" should mean reducing their net income (via hight taxes) to the same level as a person at poverty level (overstated to illustrate the point, but there are some - read "communists" - who probably do believe that).

So, what does that mean in terms of this thread? Obama's rhetoric on "irresponsible" tax cuts for the rich and increasing capital gains taxes for "fairness" is poor fiscal policy feeding on class envy - something that needs to be exposed and "put to rest".

-

Rick, your comparison is coincidental at best without further data...deceiving is more the case. The steep separation for the years shown on your graph has more to do with the gross increase of income for the top quintile while the lower quintile incomes have flatlined or fallen dramatically. Sure the rich are paying a bigger share: they're snatching more of the profits while the American worker continues to increase productivity.

-

@tomsdesk said:

Rick, your comparison is coincidental at best without further data...deceiving is more the case.

I think the term you're searching for is "historically accurate". If you don't like CATO, try the Joint Economic Committee's report (1996).

-

Phil...first, I agree completely about a flat tax! The concept has been around as long as I've been paying taxes, why don't we have one yet? (Who's against it anyway? :`)

And your little analogy is just wonderful! Well lit right on the point...with shadowy, but far reaching, moral implications!

Advertisement